20+ Rule Of 40 Calculation

Web The Rule of 40 is a principle that states a software companys combined revenue growth rate and profit margin should equal or exceed 40. Web The rule of 20 formula is.

Saas Rule Of 40 Explained Calculation Benefits More Mosaic

Web They can help you roughly answer hairy finance questions quickly so you dont slave over calculations and waste time.

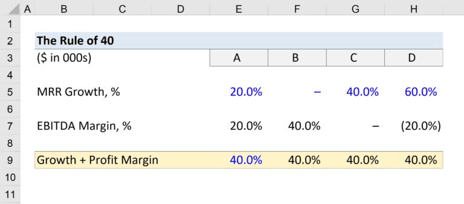

. Web This calculation allows buyers and investors to normalize these factors across acquisition or investment targets. The 20410 is a good example of one. Web The Rule of 40 is a SaaS financial ratio that compares revenue growth to profitability.

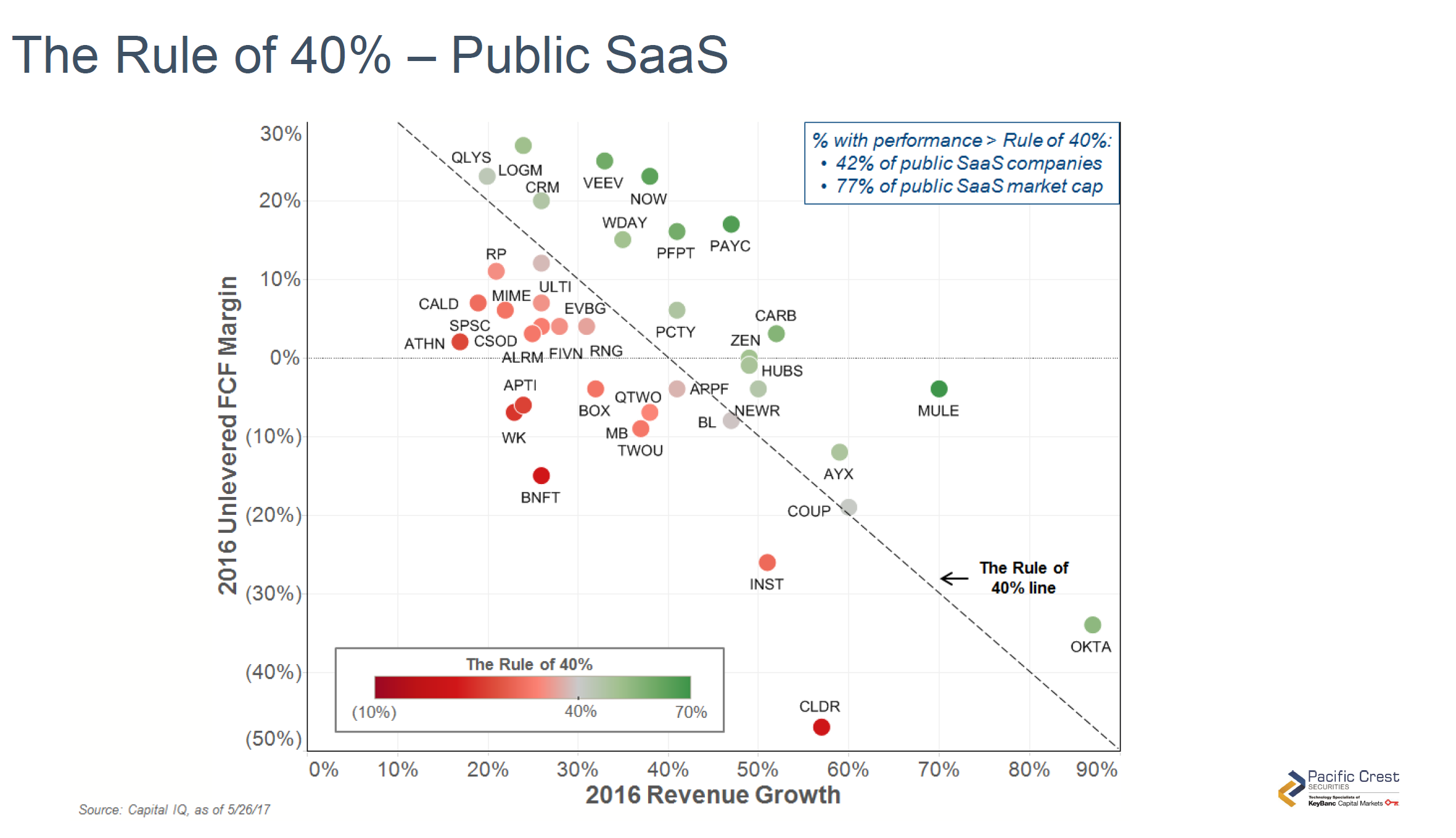

Web The rule of 40 calculation is important to measure the growth of SaaS companies. The Rule of 40 serves two valuable functions. The Rule of 40 SaaS says that a SaaS companys growth rate when added to its free cash flow rate should equal 40 percent or higher.

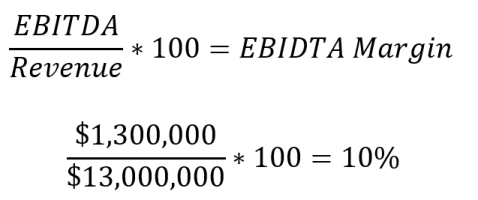

Usually growth and profit are at odds with each other especially in the early stages of a company. Web Dubbed the Rule of 40 this calculation is a way of balancing revenue and profit growth in software companies even if there are no profits yet. EBITDA gross margin or net income.

To be attractive to investors and financial lenders the growth and profit margin number should be above 40. Rule of 20frac price earningsYoY inflation rule of 20 earningsprice Y oY inf lation Where. A company can reach 40 on a Rule of 40.

There are two inputs for the Rule of 40. 50 of 4500 to your necessities which is 4500 50 100 2250. Web According to the rule you should allocate your salary as follows.

Growth and profit margin. EBITDA earnings before interest taxes depreciation and amortization is a measure of a companys. Web With the correct figures in place your Rule of 40 calculation should be.

Its an at-a-glance look at the performance of your business. First it helps SaaS leaders. Web To calculate the Rule of 40 value simply add the growth rate and profit margin for each company.

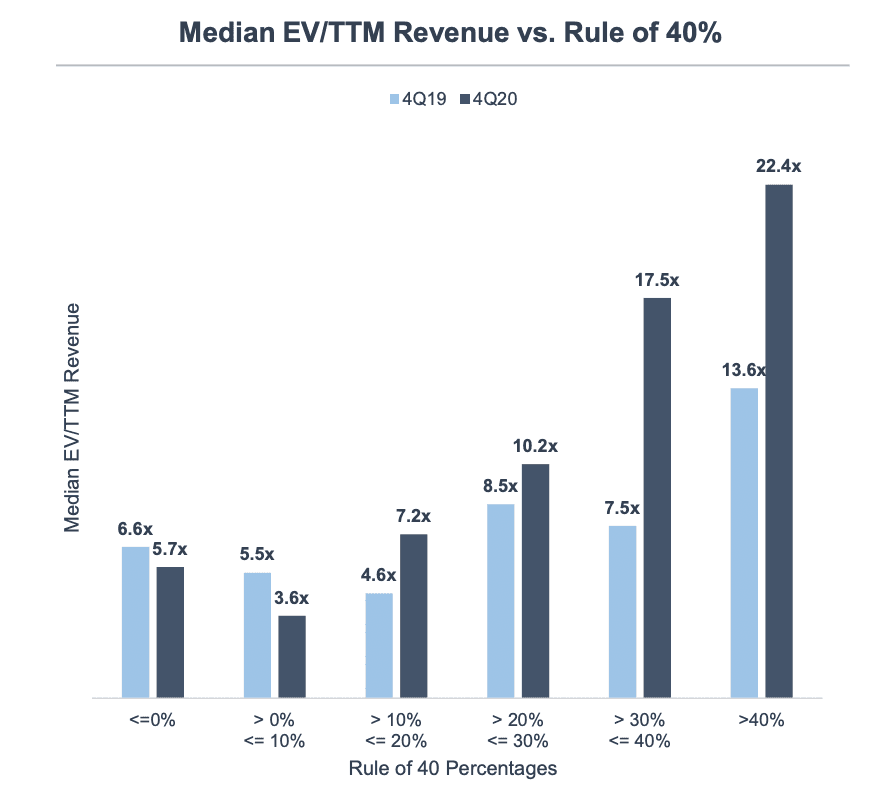

Web The Rule of 40 has been such a valuable guidepost for our conversations with entrepreneurs on the balancing act of growth and profitability that weve decided to. Web SaaS Company Rule of 40 Example Calculation A 40 20 20 B 40 0 40 C 40 40 0 D 40 60 20. 30 of 4500 to your.

Web The Rule of 40 is a simple figure for assessing the efficiency of a SaaS software companies growth and thus the quality of the business model. Price - the current trading price of a total market. If the number is too low either growth or profit m See more.

The math is easy. According to Techstars Co-founder. Type in the equal sign and add the growth rate and EBITDA.

Web What is the Rule of 40 SaaS. Why the Rule of 40 is Important. According to the Rule of 40 a software companys combined revenue growth rate and.

Web Rule of 40.

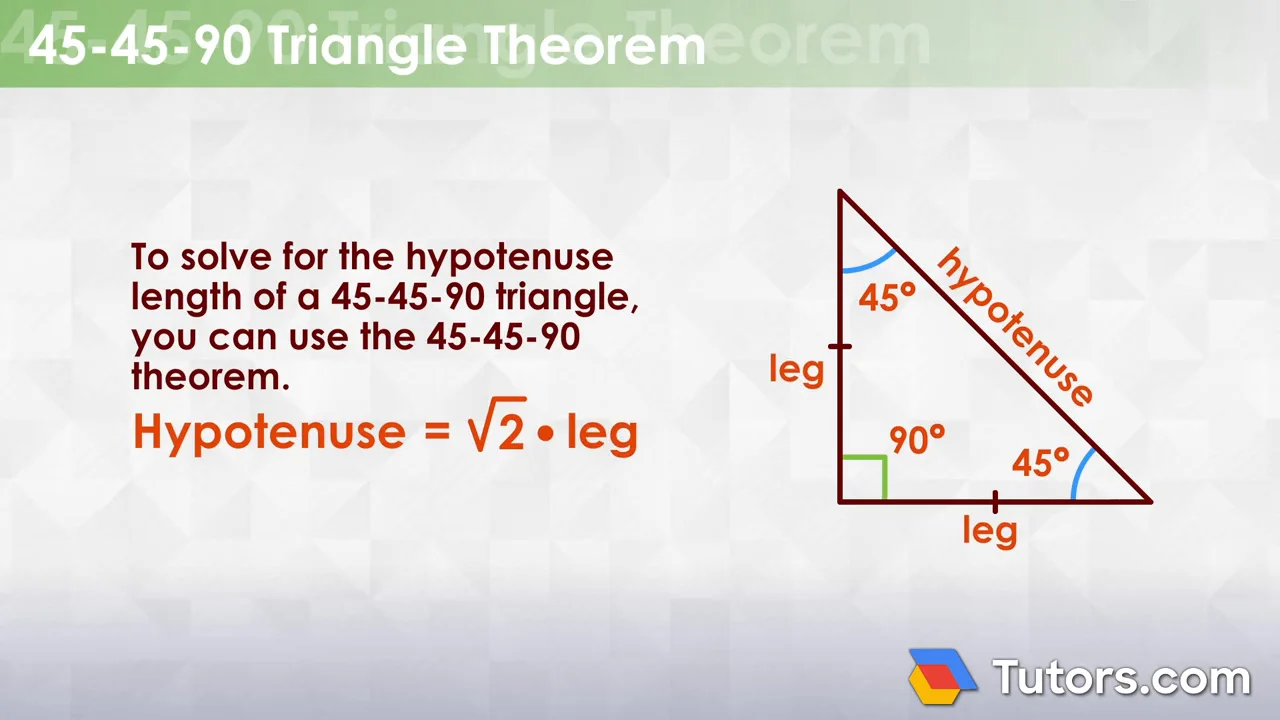

45 45 90 Triangle Rules Formula Theorem Tutors Com

Rule Of 40 And Saas What Is It And Why Is It So Important

What Is The Rule Of 40 And How To Calculate It And Use It For Saas

45 45 90 Triangle Rules Formula Theorem Tutors Com

The Saas Rule Of 40 Kellblog

Understanding The Rule Of 40 For Saas Basics Calculation And Advantages Nops

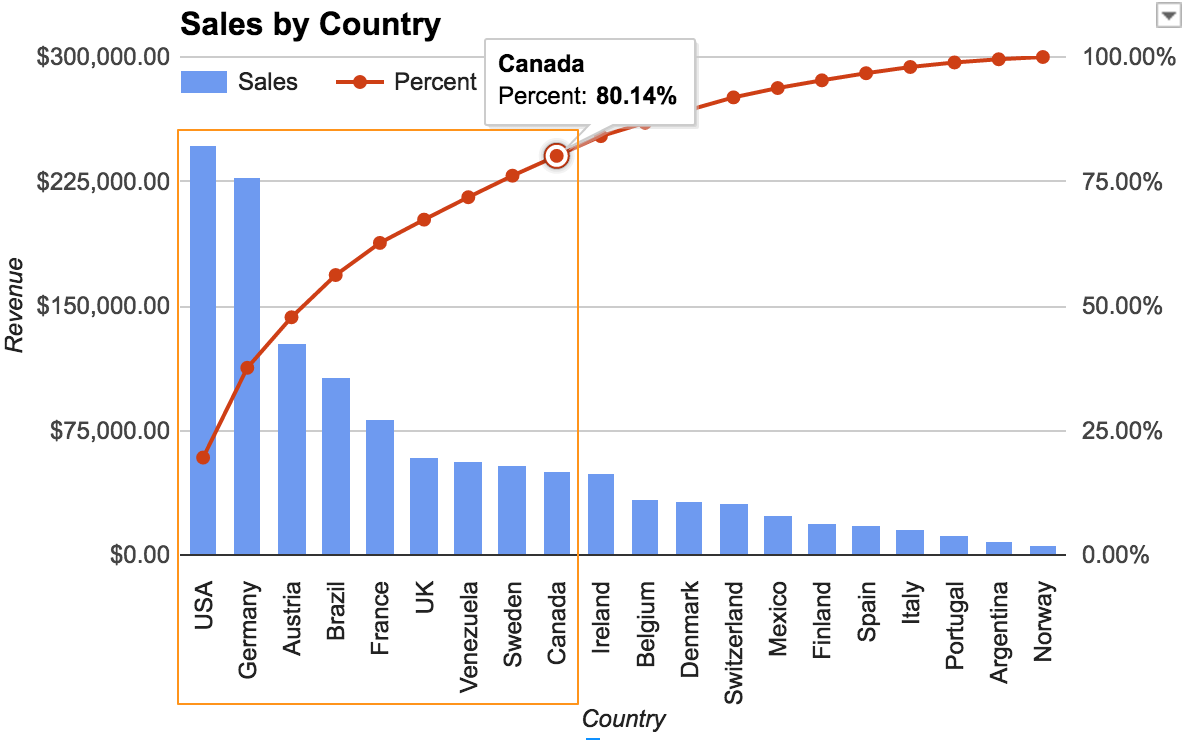

Evaluation Of Rpn Threshold Using Pareto Chart And 80 20 Principle Download Scientific Diagram

Rule Of 40 Saas Companies Growth Rate Profit Margin Supermoney

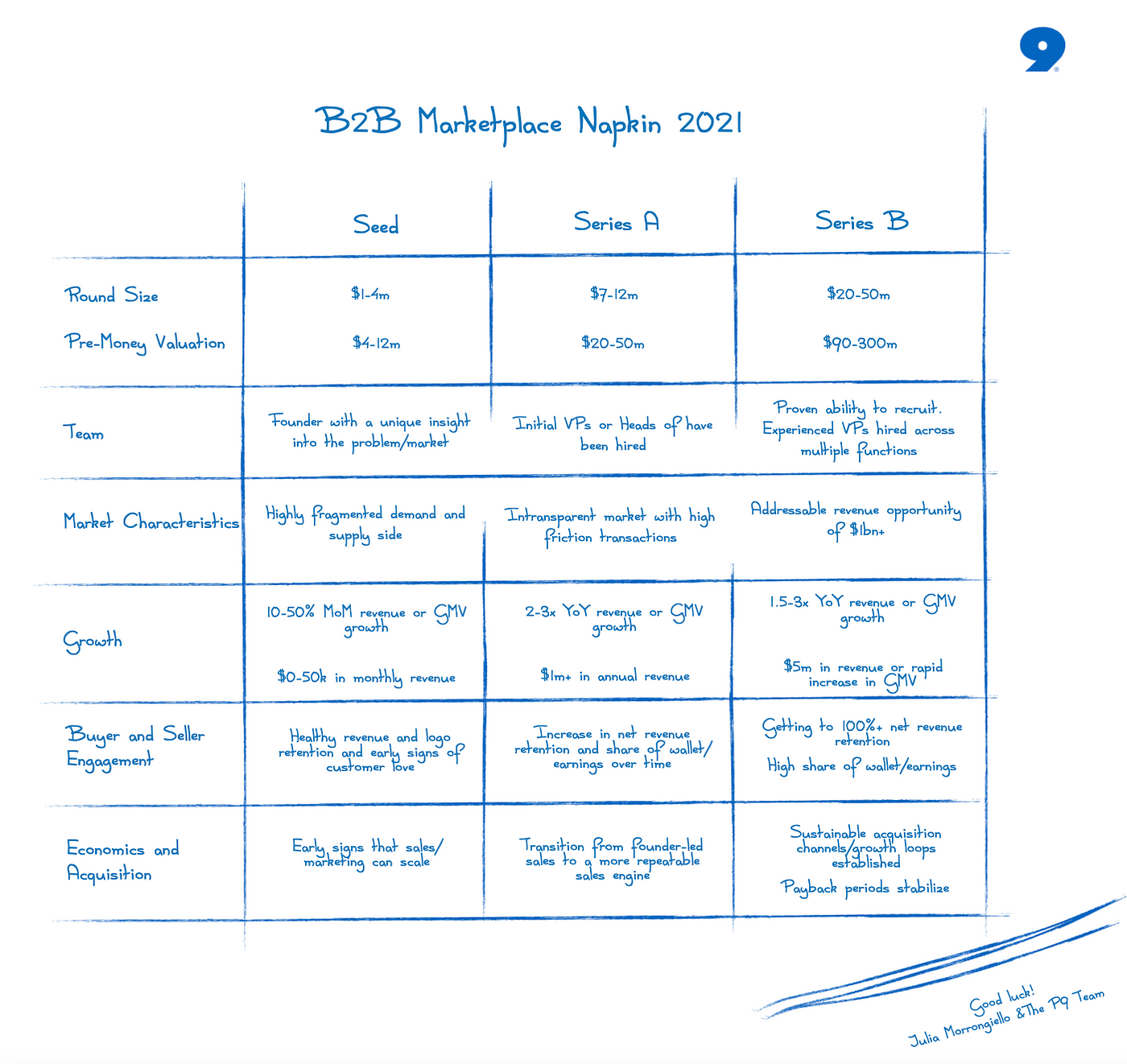

The B2b Marketplace Funding Napkin 2021 By Julia Morrongiello Point Nine Land Medium

Rule Of 40 Saas Companies Growth Rate Profit Margin Supermoney

The 80 20 Rule How To Calculate The Pareto Principle

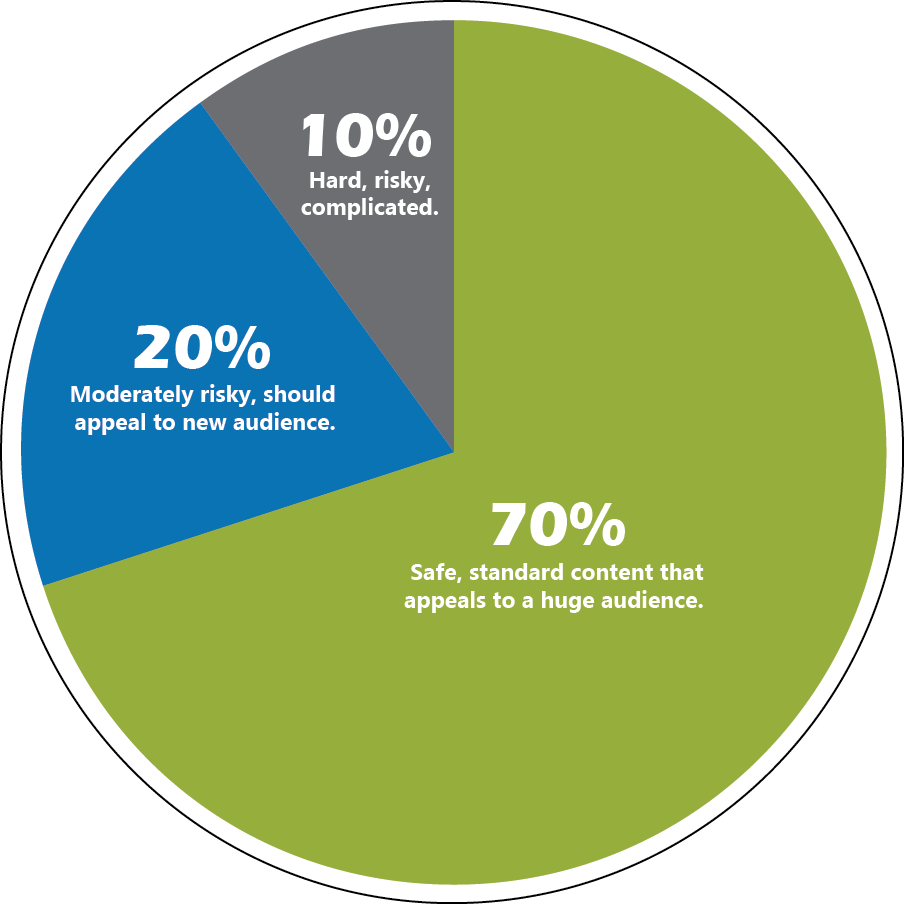

70 20 10 Marketing

Understanding The Rule Of 40 For Saas Basics Calculation And Advantages Nops

Industry Perspectives On The Saas Valuation Rule Of 40

An Update On The Saas Rule Of 40 Kellblog

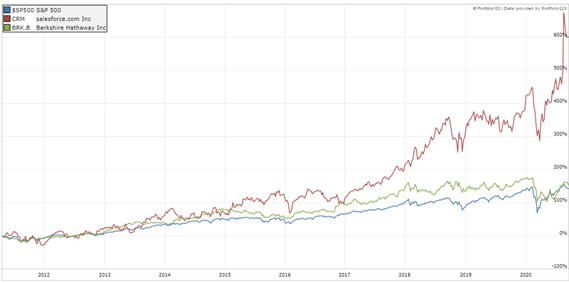

The Rule Of 40 For Saas Companies Investing Strategy Returns And Alpha Part 1 Seeking Alpha

Saas Rule Of 40 Explained Calculation Benefits More Mosaic